- Wealth Made Simple

- Posts

- How tech pros use direct indexing & tax-loss harvesting to manage taxes on RSUs and ESPPs

How tech pros use direct indexing & tax-loss harvesting to manage taxes on RSUs and ESPPs

Frustrated by recurring tax bills from your equity comp? Market volatility could offer a planning opportunity.

Dips Happen. Your Tax Bill Doesn't Have To.

You get your RSUs. You wait through the blackout period like company policy dictates. You finally sell to diversify – the smart move. But the stock price ticked up a couple of % between the vest date and your sale date. No big deal, right?

Then tax season hits. You’re staring at a few thousand dollars in short-term capital gains tax. It’s not going to break the bank, but it’s annoying. Feels like you got dinged for trying to be responsible with your equity comp. This quiet little tax drag can happen year after year with RSU and ESPP sales. It adds up. Stock market volatility feels like a kick when you're down, but what if it could be a tool? Strategies like Tax-Loss Harvesting, especially when paired with Direct Indexing, are a concept to understand.

How Can I Turn Market Losses into Potential Tax Wins?

You’ll often see paper losses on investments when the market dips. Can you actually use these losses?

Yes, through Tax-Loss Harvesting (TLH). It’s simple on the surface. You sell investments that have lost value (relative to what you paid) to realize, or "harvest," a capital loss. The IRS lets you use these losses to help offset capital gains you realized elsewhere (perhaps RSU and ESPP sales, which are common). TLH losses can potentially reduce the tax bill on those gains. Even once you offset all of your gains, if you have more losses than gains, you can typically deduct up to $3,000 against your regular income each year (great if you’re in a high tax bracket). Any leftover losses carry forward indefinitely to offset future gains.

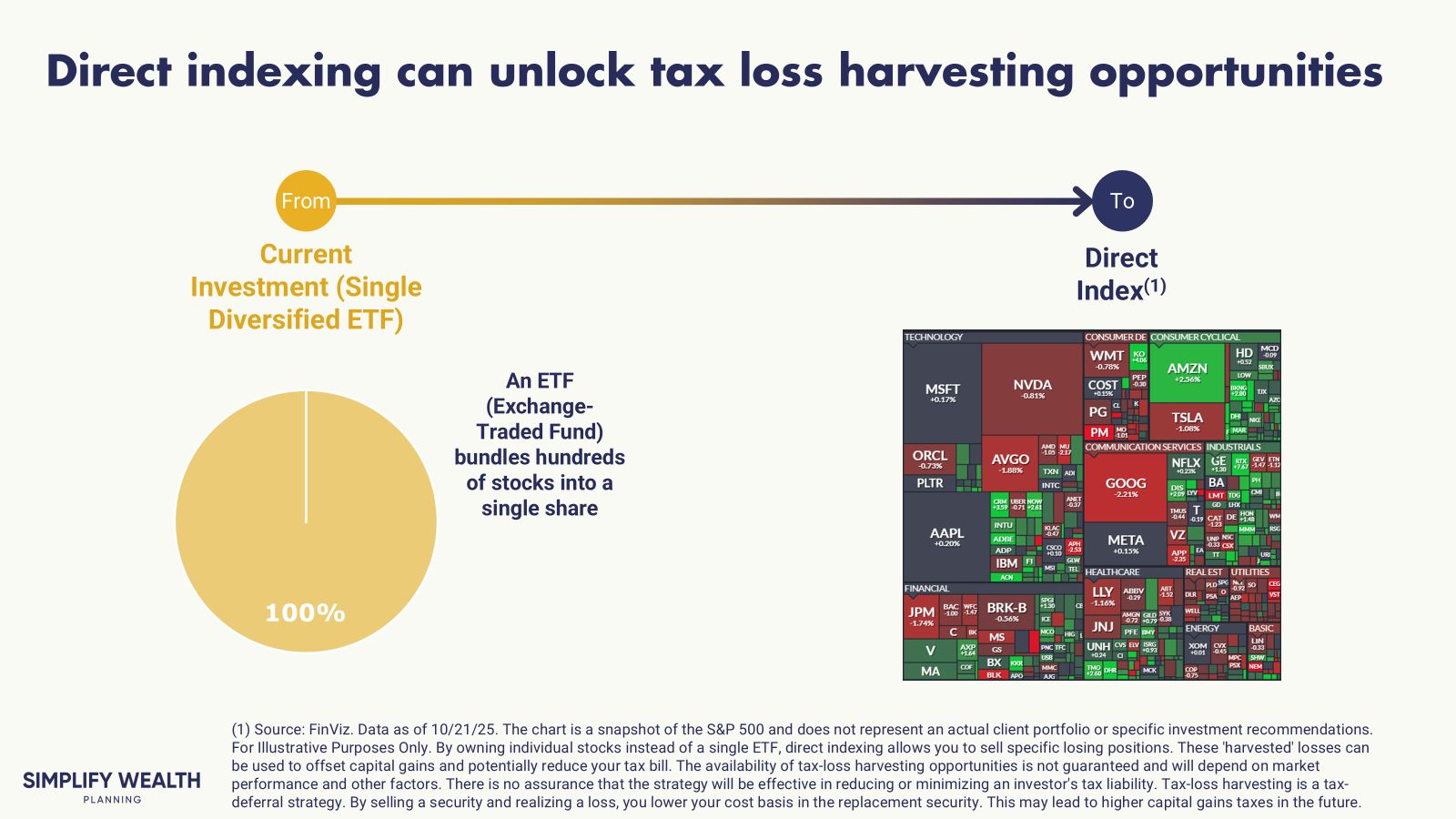

Now, here’s where it gets interesting, particularly for folks dealing with RSUs and ESPPs. Using Direct Indexing offers a better approach to TLH. Forget owning just one S&P 500 ETF. With direct indexing, you own the actual stocks that make up the index (hundreds of them). Why does this matter? Because even if the overall index is up, some individual stocks within it are likely down. Direct indexing lets you pinpoint and sell those specific losers to harvest losses, while still holding the rest of the index to maintain your overall market exposure. You can't do that with a single ETF: you generally have to wait for the whole thing to drop (again, relative to what you paid for it).

This granular approach can be relevant for tech employees. Especially for those annoying short-term gains from selling RSUs or ESPP shares shortly after purchase. It’s all about turning tax friction into a planning tool.

What Are the Real Limits and Risks of This Strategy?

This approach is not a silver bullet. It has specific risks and limitations that you must understand.

First, this strategy’s effectiveness depends on market conditions. To harvest losses, some stocks must actually go down (once again, relative to what you paid for them). In a strong, steady bull market, there may be few loss-harvesting opportunities. Also, suppose you have limited excess cash flow and can’t consistently contribute fresh capital to your Direct Indexing portfolio. In that case, your losses will eventually ossify (meaning the market trends upwards, so as that happens, loss harvesting opportunities erode).

This strategy also depends on you having capital gains to offset. Without gains, the harvested losses are limited to just a $3,000 deduction against ordinary income per year.

Second, managing this strategy involves risk. When a stock is sold for a loss, it is typically replaced with a different but similar stock to maintain market exposure. This new stock might underperform the one you sold, causing your portfolio to "drift" from the index's actual performance. This is known as tracking error. Most financial planners use software to manage this efficiently. I would not recommend trying to do this manually.

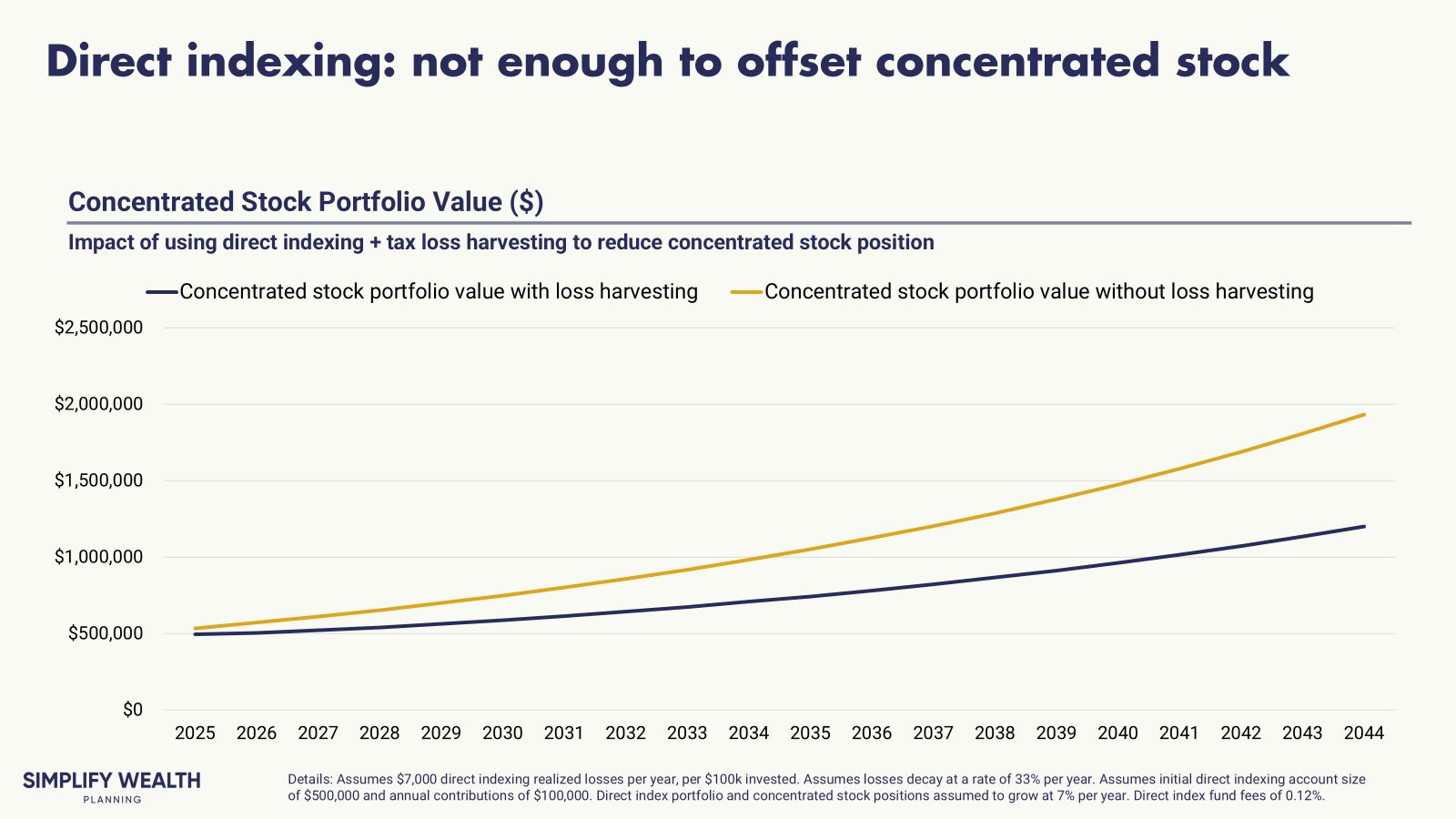

Finally, you must understand what this strategy is not for. Direct indexing and TLH are generally not the right primary tools for de-risking a massive, single-stock concentrated position (e.g., tons of employer stock you accumulated over the years). The losses harvested from your diversified portfolio are unlikely to be large enough each year to make a significant dent in the tax bill from selling millions in company stock. It's a strategy for managing the friction from ongoing, smaller sales, not for solving a major concentration problem all at once.

FAQ

Is direct indexing worth the higher fee compared to a low-cost ETF?

Direct indexing typically involves slightly higher management fees than passively managed ETFs. For tech professionals with substantial annual short-term capital gains from RSU and ESPP sales, and who are in high marginal tax brackets, the potential tax savings may exceed the slightly higher management fee. This is not guaranteed and depends heavily on individual circumstances, market behavior, and having gains to offset.

Does TLH eliminate taxes forever?

Often, it primarily defers taxes by lowering your cost basis. The main potential benefits come from tax deferral (allowing more money to compound longer - a very important concept!), potentially converting high-tax short-term gains into lower-tax long-term gains down the road, and sometimes permanent savings if assets are donated or passed to heirs who receive a step-up in basis. There is no guarantee this strategy will result in a net tax benefit.

How often should TLH be done?

Direct indexing allows for more frequent monitoring and harvesting, even daily, compared to manual reviews of ETFs or mutual funds. Automation makes this frequency practical.

Your Next Steps

Here’s what you can do to figure out if this makes sense for you:

Quantify Your Potential Tax Friction. Dig out last year's tax return. Look at Schedule D, Part I (Short-Term Capital Gains and Losses). Sum up the gains. This number is the annual tax drag you might be able to target.

Run a Personalized Scenario. Use our educational tool: Direct Indexing & TLH Savings Estimator. Plug in some hypothetical numbers based on your situation. It helps visualize the potential tax impact. Remember, this is just an illustration.

Consider a Professional Perspective. This strategy works best as part of a bigger plan. An advisor can help see how TLH and direct indexing fit with your equity comp, goals, risk tolerance, and overall tax picture.

Meme of the Week

Stop Letting Taxes Chip Away at Your Equity Comp

Market volatility doesn't have to be just a source of stress. With tax-loss harvesting powered by direct indexing, you can potentially turn those inevitable dips into valuable tax assets. This may be particularly relevant for offsetting the recurring short-term gains common with RSU and ESPP plans. It's about making your portfolio work smarter from a tax perspective.

Tired of seeing short-term gains eat into your money? Let's talk about building a plan designed for tax efficiency. Schedule an introductory call today to learn more about our approach and determine if our services are a good fit for you.

This newsletter is for educational purposes only and should not be taken as individual advice

Simplify Wealth Planning

Fast-Tracking Work Optional For Tech Pros | Turn Your Stock Comp Into Wealth, Cut Taxes & Live Life Your Way | Flat Fees Starting at $3k - Not Based On How Much Money You Have

Marcel Miu, CFA and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

Rate Today's Edition:Your feedback helps us improve. Let us know what you think! |

Disclosures

Simplify Wealth Planning, LLC (“SWP”) is a registered investment adviser in Texas and in other jurisdictions where exempt; registration does not imply a certain level of skill or training.

If this blog refers to any client scenario, case study, projection or other illustrative figure: such examples are hypothetical and based on composite client situations. Results are for informational purposes only, are not guarantees of future outcomes, and rely on assumptions specific to the scenario (e.g., age, time horizon, tax rate, portfolio allocation). Full methodology, risks and limitations are available upon request.

Past performance is not indicative of future results. This message should not be construed as individualized investment, tax or legal advice, and all information is provided “as-is,” without warranty.

The material and discussions are for informational purposes only. These do not constitute investment advice and is not intended as an endorsement for any specific investment.

The information presented in this blog is the opinion of Simplify Wealth Planning and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies.

We recommend consulting with your independent legal, tax, and financial advisors before making any decisions based on the information from this blog or any of the resources we provide herewithin (models, etc).