- Wealth Made Simple

- Posts

- Why your 401(k) might complicate your early retirement from tech

Why your 401(k) might complicate your early retirement from tech

How to lower your reported income (legally) without spending less money.

The Market Rally Reality Check

Investors have plenty to celebrate this year. The Nasdaq is up over 20% in 2025, and tech stocks continue to dominate headlines. It feels good to log into your 401(k) and see an all-time high balance.

But for early retirees or those aspiring to retire early (basically everyone in tech), that massive pre-tax 401(k) balance can be a trap.

If you retire early and try to live solely on a 401(k), the IRS and the healthcare insurance marketplace are going to take a bite out of your savings (probably a large bite). You feel rich on paper, but every dollar you spend triggers a tax event.

You need a strategy to manage that liability.

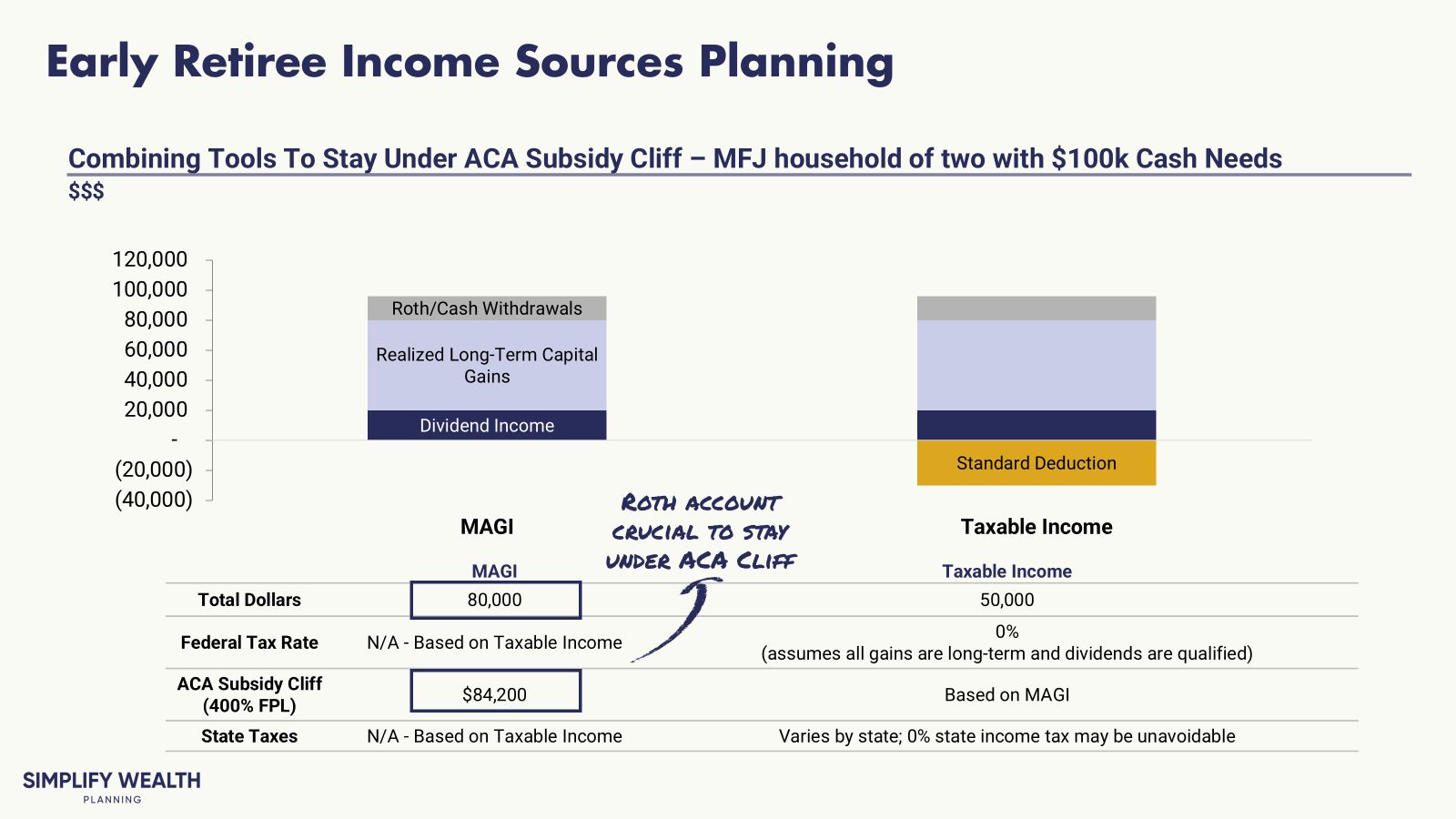

How Can You Spend $100k+ But Tell the IRS You Made $50k?

I want to retire at 55, but I hear health insurance could cost me $25,000 a year. How do I lower that?

This is a common question I hear from tech professionals planning an early exit. They look at the potential cost of private health insurance and panic.

The answer isn't necessarily spending less money. You do not need to live on rice and beans to qualify for affordable healthcare.

The answer is managing your income.

Specifically, you have to manage your Modified Adjusted Gross Income. We call this MAGI.

Now, here’s the reality of the ACA Subsidy Cliff: Affordable Care Act subsidies are currently tied directly to your MAGI. If your income is too high, including income you generate when withdrawing from accounts like a 401(k), you generally get zero help. You pay full price for health insurance, which for some could mean $20,000+ per year. If your income is below a certain threshold, the government may pick up a significant portion of the tab.

This creates a game of asset location (sounds like “asset allocation” but not at all the same thing).

If you pull $100,000 from a Traditional 401(k), the IRS generally sees $100,000 of ordinary income. Your MAGI goes up. You may lose your healthcare subsidies.

If you pull $100,000 from a Roth IRA, the IRS generally sees zero dollars of taxable income. Your MAGI stays flat. You may keep your subsidies.

The strategy is powerful: You pull just enough from taxable sources to fill up the lower tax brackets. Then you fund the rest of your lifestyle with tax-free Roth withdrawals.

You look like you have less income to the IRS. But you maintain your lifestyle in reality.

As you can see in the chart above, the goal is to fill some of your cash flow needs with tax-free Roth withdrawals, represented by the gray bar. This keeps your MAGI (the sum of the blue shaded bars) low enough to potentially qualify for healthcare subsidies.

Note: Tax laws and subsidy thresholds are subject to change. Always consult with a tax professional regarding your specific situation.

Why High Earners Often Miss the Boat

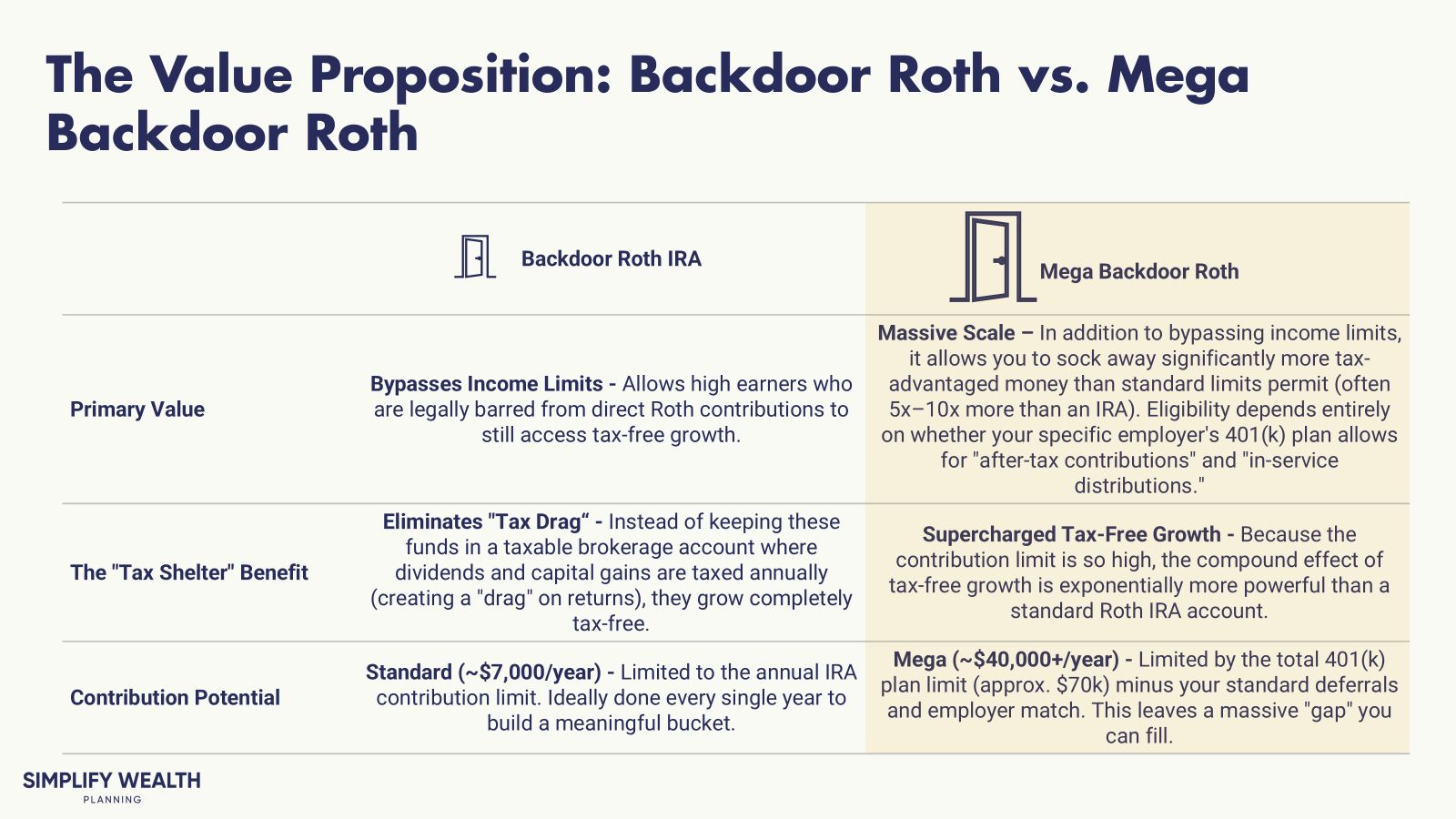

High earners often ignore the Roth bucket.

Their rationale is this: I make too much money to contribute directly to a Roth IRA. Or they prioritize the upfront tax break of a Traditional 401(k) because their current tax bracket is high.

But life is never so simple.

If you enter early retirement with zero dollars in a Roth, you have limited flexibility and will likely have painted yourself into a corner.

The solution is to build tax diversification now. But you may still say “I make too much money for a Roth IRA”.

However, you can consider strategies like the Backdoor and Mega Backdoor Roth while you are still earning a paycheck. These allow you to fill your tax-free bucket regardless of your income level.

Note: You can only do a Mega Backdoor Roth if your employer’s 401(k) plan specifically allows for it. You will likely know if this is available, since people will probably talk about it, but there are ways to research on your own to find out (see chart below).

FAQ

Can I really use my Roth money before 59½?

Yes, but there is a nuance you cannot ignore. Contributions you make directly to a Roth IRA are generally tax and penalty-free. You can take that principal out whenever you want without penalty. However, for funds accessed via Roth Conversions, like the Backdoor or Mega Backdoor strategies we discussed, you generally must wait 5 years from the conversion date to access the principal penalty-free (each conversion has its own 5-year clock). This is why planning your conversion ladder years in advance is critical. You need to "age" your money.

Is it too late to start a Roth if I retire in 5 years?

No. It is rarely too late. You might execute high-volume Mega Backdoor contributions now to start that 5-year clock. Or you can plan for Roth conversion years immediately after you retire when your income drops. This fills the bucket for your later years.

Your Next Steps

Audit Your Buckets. Look at your total portfolio right now. Calculate the percentage that is Pre-Tax Traditional 401(k) or IRA. If that number is 90 percent or higher, you are tax-heavy. You may have a flexibility problem. Aim for a healthier mix where you have meaningful assets in Taxable Brokerage and Roth accounts.

Check for the Mega Option. Log into your 401(k) portal today. Do not assume you know what is in there. Search the plan document for "After-Tax Contributions." This is different from Roth 401(k) or Pre-Tax 401(k). If your plan offers this, it may be an opportunity to contribute an extra $30,000 or more into a Roth annually.

Map Your Gap Years. Calculate the specific number of years between your desired retirement age and age 65. Age 65 is when Medicare kicks in. This gap is your high-risk window. This is the period where having a Roth balance is most critical to controlling your costs.

Harvest Tax-Free Gains. If you have low income years coming up, like a sabbatical or the first year of early retirement, plan ahead. You can potentially realize capital gains up to the 0 percent federal bracket limit. This resets your basis without immediate federal tax liability. It is a use it or lose it opportunity.

Meme of the Week

Build Your Escape Hatch

Do not head into early retirement without a plan for your income sources. A Roth IRA is a release valve that can help manage your taxes and healthcare costs when you stop working.

Not sure if your current asset portfolio is ready for your dream early retirement? Schedule an introductory call today to review your strategy.

This newsletter is for educational purposes only and should not be taken as individual advice

Simplify Wealth Planning

Fast-Tracking Work Optional For Tech Pros | Turn Your Stock Comp Into Wealth, Cut Taxes & Live Life Your Way | Flat Fees Starting at $3k - Not Based On How Much Money You Have

Marcel Miu, CFA and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

Rate Today's Edition:Your feedback helps us improve. Let us know what you think! |

Disclosures

Simplify Wealth Planning, LLC (“SWP”) is a registered investment adviser in Texas and in other jurisdictions where exempt; registration does not imply a certain level of skill or training.

If this blog refers to any client scenario, case study, projection or other illustrative figure: such examples are hypothetical and based on composite client situations. Results are for informational purposes only, are not guarantees of future outcomes, and rely on assumptions specific to the scenario (e.g., age, time horizon, tax rate, portfolio allocation). Full methodology, risks and limitations are available upon request.

Past performance is not indicative of future results. This message should not be construed as individualized investment, tax or legal advice, and all information is provided “as-is,” without warranty.

The material and discussions are for informational purposes only. These do not constitute investment advice and is not intended as an endorsement for any specific investment.

The information presented in this blog is the opinion of Simplify Wealth Planning and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies.

We recommend consulting with your independent legal, tax, and financial advisors before making any decisions based on the information from this blog or any of the resources we provide herewithin (models, etc).